FrontDoor inc (FTDR): An opportunity to buy the biggest home warranty player at its lowest valuation in its history at a 41% IRR (2x in 2 years)

Current Price: ~$35 | 2-year Price Target: $65-$75 | NASDAQ: FTDR

Join the mailing list for future blogs: Click here

Model: Available to download here (https://docs.google.com/spreadsheets/d/1snVZOkAikZAPWc0xeMMFYKBcvGHuSLFZ/edit?usp=drive_link&ouid=100501050702536154043&rtpof=true&sd=true)

Company & Industry Overview

FrontDoor Inc. is the owner of American Home Shield (along with other brands), the largest home warranty brand in the States, and collectively with other brands has approximately 2 million warranties out of approximately five million warranties (5 million houses out of 127 million houses) that generated $1.7 billion in 2023 out of a $4 billion industry. They have also recently launched an app, which provides on-demand services and consultation. Four segments of revenue: Renewals (2nd year of Warranty), DTC (1st year of Warranty acquired directly, website, etc), Real-estate (1st year of Warranty attached to an existing home transaction), others (App, etc).

The industry from 2022 to 2023 lost 10% in warranties. The reasons for this are falling existing home sales (6.1 million homes sold in 2021 vs 4.1 million in 2023).

Investment Thesis Summary

There isn’t an argument for higher penetration or a quick turnaround in the real estate cycle. Instead, the argument is that the market has treated the stock as cyclical play, where the multiple has troughed with peak mortgage rates; however, underlying structural factors indicate high stickiness with customers, with pricing power and strong margin structures. There are two things to consider, is this a value trap and what is the trigger? This isn’t a value trap as individually declining warranties aren’t a structural worry and an inevitable recovery to real estate and inflation easing (over the next 2 years) will increase the introduction of customers and trigger a recovery proving misinterpretation of the stock. To summarise, earnings will compound more as renewal rates increase (66 to 77% from 2018 to 2023) over a larger base.

Thesis 1: Renewals are price inelastic and introduction elastic which justifies warranties will bounce back as the cycle corrects and in-built cyclical resilience

Fig 1 clearly indicates that while total warranty holders have fallen for FrontDoor since 2021, that has never been the case for year-end warranty renewed holders. This is despite price increases of double digits in 2023 (~11% as per mgmt. in Q4 earnings call and 11.4% as per my estimates). Yet renewal rates (1st year customer renewal rates are reported separately, Fig 2 refers to renewal rates after 1st year of customer renewal) were 66% in 2018 to 77% in 2023. (From a Forbes home survey of 1000 participants, 67% thought their home warrant policy was worth it showing a slight positive differential for 67% vs FrontDoor’s 77% renewal.) The reason for this is that as the largest warranty provider FrontDoor can iterate through multiple service providers to curate its preferred vendor list that serves most of the community. As per annual reports, FrontDoor has 15,000 contractors as of 31st December 2023, of which 4000 are preferred and catered to 83% of the jobs. This was 82% in 2022, 2021, 2020 and 80% in 2019. By creating a Reddit thread and self-engaging with customers, I understood that when the customers found a relevant contractor who could reasonably fix their problem, they stuck to the warrant knowing future problems could happen. It’s not just cost saving, but the ease of solving. This aptly summaries that with a great platform-like model, with good execution stickiness can be created for existing customers ONLY.

As per a realtor on a separate thread, “Actually just had this conversation with a warranty company. Their business model is that most of their profit comes from renewals, and they've found renewals have decreased because their coverage sucks….” This is because of predictability in repairs, following predictable cashflows, and reducing user-intensive ad spend ($156m advertising to acquire ~400k - ~500k customers as per personal estimates for FrontDoor). A price-inelastic segment of FrontDoor helps FrontDoor still compound revenue and earnings in a down cycle (not true for all competitors). This also is not due to the cognitive load of non-renewing because FrontDoor contracts are only for a year and customers have to task to renew.

FrontDoor divides warranties on 1st year of subscription separately acquired through real estate and DTC. Fig 3 depicts the relative price elasticity for acquiring new customers through the DTC channel (website, etc). With inflation (contracted workers, parts and equipment main sources) rising, FrontDoor protected it’s bottom-line without affecting its topline from a strong renewal base. They have still acquired new customers (from the DTC channel), who have a 73%+ first-year renewal rate. Q1 of FY 24 also had falling DTCs, but mgmt. in earnings accepted aggressive pricing with double-digit growth and an unnecessary 51%+ GM. They have since explicitly stated iterating with more discounting as inflation evidently eases. Mgmt indicated the industry fell 16-17% for FY 23 from FY 22 but FrontDoor volumes were still positive (no accurate industry number but 5/ 6 million active warranties in the US each year). I believe this suffices the question if it’s a value trap or an opportunity, as FrontDoor has still thrived on controllable inputs, while the industry struggled.

Thesis 2: A tough real estate cycle that the market has overfocused on and misinterpreted

In the months preceding the note, the Fed has been more hawkish and reduced the likelihood of reducing rates aggressively, therefore reducing real estate buying power, therefore reducing selling willingness due to selling with locked-in low interest rates.

In real-estate transactions, as stated in FrontDoor’s investor day and reiterated by realtors I consulted (over Reddit), it’s most often the seller that pays for this in this real-estate channel. In a seller’s market that 2021 created, there isn’t a need for it. Sellers use it to sweeten the deal or avoid nondisclosure lawsuits. “Most importantly, it helps prevent nondisclosure lawsuits. If you've ever been involved in one, you do everything you can to prevent it from happening.” The buyer also pays for this as per certain realtors as they aren’t exactly in the best financial position after a serious capital outlay for at least 1-2 years (also affected as that wasn’t the case from increased borrowing). Moreover, transactions have been relatively quicker for the buyer to take such steps as well.

Fig 6 and 7 jointly will more aptly explain this, but a sudden flow of money created a prolonged spending spree for which there didn’t exist enough inventory in 2021. In 2022 and 2023, people were unwilling to sell these by locking in lower rates. As the market rightly predicted, real estate transactions increased propelling the multiple to its peak (Fig 5), but that was the wrong thing to do as a volatile market created an unfair balance between a buyer and seller. Within the next 2 years, the market doesn’t need rapid rate cuts or a 2021 real estate boom, but a more balanced real estate market. This is likely to be the trigger, which is gentle(r) rate cuts over the next 2 YEARS creating a balanced real-estate interaction where the buyer and seller both need to throw in a bone.

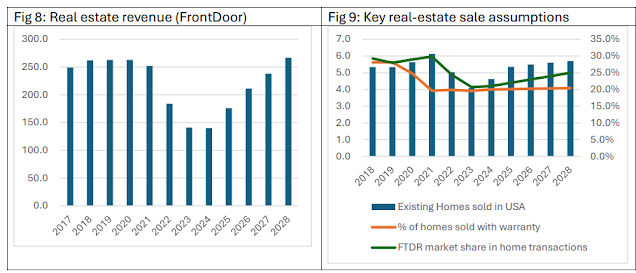

Note: Real estate revenue means 1st-year home warranties purchased through a real estate transaction

Fig 8 will depict I do not expect an immediate rebound in FY 24, as FY 23 carried a lot of FY 22 warranties (Warranties are for 1 year) so the math kept FY 23 strong despite more warranties expected by the end of 24. Fig 9 depicts other key assumptions on the real-estate assumptions derived from third-party sources (industry data), including mgmt. that also predicted FY 23 home transactions lowering in FY 22 Q4 investor day. Source: National Association of Realtors (NAR)

Fig 8’s FTDR market shares in home transactions is a personal estimate, which isn’t nearly as severe as per mgmt’s comments on the earnings call. After analysis and understanding of broker partnerships, the best reasonable analysis for FTDR’s decline in warranties sold (% of the industry in real-estate transactions) was FTDR’s concentrations with affiliated brokers in areas most affected.

Thesis 3: There is higher certainty in cash flows and margins, that has maintained and will continue to improve returns on capital

FTDR’s only major current asset is its cash pile (48% of cash is restricted required by some state laws). FTDR has been able to keep up with inflation from FY 23 and FY 24 Q1 (where they overestimated inflation and aggressively priced) as explained in thesis 1. Moreover, all payments are immediate without a receivable cycle; its PP&E is 95% internal technology and communication tools it uses, and they don’t hold the parts and equipment themselves. Hence, CFO and FCF have been more than net income every year. More importantly, unlike insurance companies, it can control costs for reimbursements and cash flows associated with it. Negative deductions in working capital have only been from 2021 due to falling deferred revenue not as an indication of unwilling customers (customers immediately sign a 1-year contract despite payment timings). It has instead been due to falling real estate sales, where realtors or sellers (mostly sellers) just pay 1-year in advance for ease. As that improves, it can be expected that every CFO adjustment be positive (D&A, WC, SBC). This allows it to buy a lot of stock back (promised and delivered $280m from FY 21 – FY 23 for a net income of $370m in the same duration) and pay off its debts in the future. You get a tax-adjusted EBIT margin of 11%+ with a Capital employed turnover of 2.5x+ (pre-acquisition math).

Thesis 4: An unpriced acquisition and a promising app play

FrontDoor acquired 2-10 Home Buyers Warranty for $585m on a cash-free debt-free basis on June 4, 2024, expected to close by Q4, 2024. The market has either priced in no regulatory approvals for this transaction (for anti-monopolistic reasons) or priced it as immaterial/ negative to earnings. For scenario 1, I haven’t modeled in the acquisition and get my target price on the first three theses and modest app growth. Scenario 2 (quantitatively is not positive, but downside is limited): -

1. FY 23 numbers were $198m in revenue and $43m adjusted EBITDA (EBITDA - SBC + interest income). I estimate pre-tax profit to be around ~$34m. This could be $42m (compounded 10% annually) by FY 25 (1st year of completion under FTDR books). That’s about the interest payment on a fully debt-financed under the current FY 25 EIR with interest rate hedges. So, it’s not exciting quantitatively (if anything negative) as it expects compounding.

2. FTDR has clearly struggled with DTC penetration in inflationary environments. I estimate it had 228k new warranties in this channel as of December 31, 2023. 2-10 has approximately 292,000 customers overall (largely new homes)

3. While 2-10 also has a warranty business (multi-folds smaller than American Home Shield), its main business is first-home purchase insurance products (1 in five new American Homes). When Americans buy new homes, builders buy insurance for customers. These are users of products, who may or may not purchase warranties depending on how new the hardware is, but cost-effective cross-selling is reasonably possible for new customers and existing ones with aged hardware.

4. The numerous synergies of using the same preferred vendors and managing marketing spend by weighing geographical strengths

Other revenue largely entails platform fees, ancillary services, and most importantly app subscriptions now. The app has already crossed 2 million downloads and utilizes FrontDoor’s technicians who have aided in increasing YoY renewals. For fixed subscriptions, the app aids customers with fixed prices for on-demand services and free video consultations for self-fixes/ next steps.

Valuation

I have reached a 2-year target price (and recommend 2-year for compounding recovery, larger timeframe for cycle recovery, and better exit scenarios) of $65 - $ 75. I estimate a FY 2025 EPS of 2.6 and FY 2026 EPS of 3.5 because of existing double-digit pricing actions (not future) that have raised the pricing base. I consider trailing multiples as well as don’t want to solely rely on the street having an aligned FY 2026 consensus.

· Predicted Forward P/E of 21.0x and trailing of 24.0x (75% DCF (20.2x/ 23.0x) + 25% average multiple (22.3x/ 25.5x)), $63 - $73, 0% DCF Margin of safety

· Average Forward P/E of 22.3x and trailing P/E of 25.5x, $67 - $78

The price target is based on the above two scenarios

· Predicted Forward P/E of 18.0x and trailing of 20.0x (75% DCF (16.1x/ 18.4x) + 25% average multiple (22.3x/ 25.5x)), $52 - $62, 20% DCF Margin of safety

· Current Forward P/E of 14.1x and trailing P/E of 15.3x, $40 - $50

The below table attaches some comp comparisons (Direct competitors not listed, owns 3 of 6 biggest brands if 2-10 acquisitions goes through)

It shows FTDR vs ADT is severely undervalued given its more efficient use of capital for sustainable reasons.

Risks

1. Mentality change, 2 realtors mentioned that this is also an “old-school thing”; DTC drying up and marketing iterations may not work; there is massive dislikes for such platforms on online websites like Trustpilot and Yelp (but the same for insurance companies)

Risk largely mitigated by need to of acquiring ~8-9% more (real estate and DTC customers) in FY 24 than FY 23, ~20-21% more in FY 25 than FY 23 or ~26-27% more in FY 26 than FY 23, still less than FY 22 numbers. Furthermore, it is only ~0.3 to 0.4% of all American houses per year. In a serious structural decline (-20% YoY for Real Estate volume and -10% YoY for DTC volume), EPS for FY 25 and FY 26 can be $2.2 and $2.6 by my estimates as I still believe renewals will be the same and they would manage margins. This necessitates my 2-year holding period. I do not see negative pricing overall on revenue (discounting is booked as ad expenses already). To just break even on the stock, you would need the multiple to not fall by more than 18% each way.

2. Weather is a huge risk as very hot summers or cold winters create more HVAC repair/ replacement demands from overuse, but it’s large enough and the investment period is long enough to smooth that out

Relevant website links

https://www.trustpilot.com/review/ahs.com

https://www.yelp.com/biz/american-home-shield-batavia-4?hrid=PKLpSJLBmhtriFC7woBOAQ

https://www.reddit.com/r/realtors/comments/1dfmskk/home_warranties_us/(My initiated thread)

https://www.reddit.com/r/RealEstate/comments/1dfp9w7/home_warranties_what_has_happened_to_them/ (My initiated thread)

https://www.forbes.com/home-improvement/home-warranty/are-home-warranties-worth-it/

Comments

Post a Comment