Natural Grocers by Vitamin Cottage Inc. (NGVC): Buy a unique high growth (12% hist EPS compounder) organic only grocer at less 15 times NTM P/E

Current Price: ~$26 | 24-month Target Price: ~$47 Dividends ~$1.3, TSR: 85% | NGVC

Join the mailing list for future blogs: Click here

Model: Available to download here

Competition isn’t a 0-sum alpha battle, its adding value where existing players don’t.

NGVC is a great business model with strong moats, supporting a long runway of unit and same store sales with plenty of operational leverage yet to realise.

Why buy an under $600m market cap grocer?!

Michael Potter’s Principles on competition aptly summarises NGVC’s (Natural Grocers by Vitamin Cottage Inc) strategy. They aren’t here to challenge Kroger’s, Walmart, etc. Instead, they are here to serve less price sensitive, and instead, more, value-seeking consumers. They serve organic groceries at relatively competitive prices with relatively superior service, by on average relatively paying their human capital more. A consumer of NGVC is assured of quality; 100% organic produce only in groceries; employees who not only direct customers to the right aisle but recommend the right aisle; nutritional health coaches doing weakly classes, and lastly having other stores nearby by being located near anchor store areas.

Company & Industry Overview

• 59% owned by family currently, at IPO it was 59.6% owned by family (in 2016-17 it was 57.3% of stock)

• 70% Grocery (Organic only), 21% dietary supplements, 9% body care pet, etc

• As per Nutrition Business Journal long-term CAGR in organic and natural food groceries is exp around 5% and supplementary should be 4.5%. Historically it has been high single digit since 2012 to 2020

• At IPO in 2012, it was 59 stores in 12 states, as of 30th September 2023 it was 165 stores in 21 states

• Founders: Margeret Isely & Philip Isely opened the first store in 1958; second generation Kemper & Zephyr (Co-Presidents) & Heather &Elizabeth Isely(s) (Co Vice-Presidents) purchased biz in 1998 with 11 stores

Thesis 1: Focus is the greatest lever, and NGVC has monetized on this lever and can continue to do so

Of well-known competitors from Kroger’s, Safeway (owned by Albertsons), Walmart, Target (less grocery more conventional retail now), Whole Foods, Sprouts, Costco, Sam’s clubs (Walmart run), Natural Grocers is the only retailer selling 100% organic food only. Sprouts come close in terms of strategy, but they are ~25% of sales organic vs NGVC at 100% (less supplements and some body care products).

This may seem foolish at sight as you certainly can’t be 100% organic for minimising costs from a customer’s POV, but it positions its stores only in anchor locations, where there is a cohort of retail shops (usually grocery stores only so you fill your entire basket at once). This strategy allows it to be a low-cost procurer of goods vs Krogers (Regionally most similar) vs Whole Foods (Similar strategy and same primary supplier UNFI, 10-15% cheaper on most organic SKUs) vs Sprouts. Naturally, these are also higher margin products which suits the bottom-line better.

Note (Fig 1): States with at least 10 NGVC stores for good comparison, at least 7 store reviews per state, minimum 300 reviews per state cumulative of 7-10 stores yelp reviews, Krogers data is: King Soopers for Colorado (owned by Krogers, has 2 stores outside Colorado), Krogers for Texas, Fred Meyer’s for Oregan (owned by Krogers, Oregan, Washington, Idaho, Alaska), Fry’s for Arizona (100% only in Arizona). Costco didn’t have enough data but represents a fair representation (200 inputs over 2 stores).

The primary reason for strong reviews is exceptional service and quality products (including supplements 20%+ of sales which they also test internally to some extent for label claims). Prices also seem reasonable after reading reviews. This enables them to spend more on manpower (as noted by mgmt. & Fig 3), who recommend and explain to consumers what to buy and why to buy (yelp reviews & Annual report). Each store has a nutritional health coach, who along with other employees conducts weakly cooking classes and more.

To summarise by focusing only on organic goods, the company has mastered the supply chain to source products consumers want at “Every Day Affordable Price” for goods that are inherently higher margin products allowing them to get relatively better real estate with better employees. This encourages customers to visit stores. Visitation of physical stores (in an anchor community), with more informed and welcoming staff, encourages more spending even in mature stores (5 year+ old stores look at Fig 4). The business wins as same-store sales increase (average selling square feet has been the same since 2018), which is the primary catalyst for operating leverage in retail outlets. This cycle goes on.

Thesis 2: Long-run growth is imminent, evident and sustainableUp until the 2016 Annual reports, the Buxton study mentioned an additional 200 stores in existing states and 1000+ stores nationwide. As per Nutrition Business Journal a 5% long-term CAGR is expected in organic and natural food groceries alone and supplementary should be 4.5%. Given these industry numbers; thesis 1 pronouncing NGVC’s secret sauce, and historical results, a ~5% same store sales, at roughly similar average selling square feet, is likely for me.

The issue lands towards store growth and the risk of cannibalisation (Cannibalization means stores opening next to each other that hurt each other). This lands to a 2-part question, can mgmt. efficiently open stores (without hurting existing stores) and what’s the runway of opening stores.

Addressing the latter question is slightly easier: -

1. Krogers, Walmart and other large non warehouse grocers are 100k selling square feet+ supermarket models and even sprouts a closer comparable is twice the size of NGVC. NGVC is a ~10,600 selling square feet model and total square feet 50% above that. Unlike other grocers NGVC isn’t replacing a larger scale store, it’s replacing any specialty store or larger grocer. Walmart has closed 154 (net) stores since 2018, Kroger’s 42 and other major grocers as well due to operational headwinds from rising costs on non-differentiable commodity groceries. This is an opportunity to fill square feet

2. If the Kroger’s Albertsons merger goes through, this creates a store tailwind for NGVC. Kroger’s covers 80% land mass for NGVC stores and is the closest geographical comparable. Post merger Colorado will foresee 91 store closures (biggest state), 28 stores in Texas (2nd biggest), 62 stores in Oregon (3rd biggest), and 101 stores in Arizona (4th largest). In total the divesture would include 186 stores. This is a major catalyst to fulfill grocery real estate as Kroger’s Albertsons looks to avoid post-merger cannibalism.

Answering the first question is that mgmt. learned aggressive store openings the hard way as in 2016-2017, the oil crash was not the only reason for dropping comp sales. For instance, in Denver alone, they opened 2 stores next to their original Denver store.

Fig 5 will indicate that store growth has calmed and the 6-store yearly projection is in line mgmt’s 4-6 store guidance. If we choose 4 or 5 stores without closures, it is more accretive for the business due to less lease costs, less capex and associated D&A, & less pre-opening expenses.

The first marked period (2016-2017) is explained by the oil crash majorly, then food deflation (especially almonds and other dry fruits: high-selling organic items), and lastly the least by cannibalization. As per mgmt. (comparative sales were close to the historical number for all states except Oklahoma, Colorado, Wyoming, and Texas). In 2016 – 2017 they contributed to 50% and 48% of units, and as of 2023 September, they contributed to 46% of units. Shall we see a period of deflation in groceries in the United States again or an oil crash is unpredictable and a key risk this business exhibits in exchange for higher quality & growth that originates from a lower base.

The second marked period (2021-2023) was an inflationary period, where downgrades in customer choices were prevalent as the Walmart’s performed above average and NGVC’s below average (Sprouts 2021 was -6.7% same-store sales).

Thesis 3: Operational leverage play is still left to play & NI margins can reach ~4.5% by 2029

Key driver for operational leverage is increase in comparable same store sales (13 months min only counted as comparable stores). As explained in thesis 1, and thesis 2 most periods witness that. If we see mean reversion, NGVC’s discovery for operating leverage is highly probable which this investment prices in and possibly overlooked by the market (currently no sell-side coverage).

Fig 8 shows increasing purchasing power from distributors primarily because NGVC is the only 100% organic grocer billing $1b+ in annual sales. This pushes NGVC into a unique position with suppliers.

Fig 9 also shows improving GMs, except there was a deflationary period with a demand shock. This period also had 15-20 stores opening per year pressuring occupancy costs. Mgmt also commented gross profit falling to taking expensive leases to expand stores. In 2015, NGVC did also launch N-Power which has scaled from 750k members in 2018 to 2.1m members in 2023. This also helps them marginally with finding more margin accretive products for customers. Generally, by Fig 8, we should see some margin accretion primarily from compounding sales exceeding store growth and store lease costs. I have relied less on an assumption whee we see more purchasing power to maintain my conservative projections.

If I compare this to other stores operating expense % of sales, we see that the operational leverage play is still left to play provided the company can compound sales. (Fig 10)

To summarise: A great business model with strong moats, supporting a long runway of unit and same store sales with plenty of operational leverage yet to realise.

Thesis 4: Valuation

NGVC is a ~19% ROE business with negative net debt (comps are 20-25% ROE with more levered positions). In comparison, NGVC is a ~20% ROIC business (Tax adjusted EBIT divided by total debt + equity) with comparison only from Costco that trades at a 53 trailing multiple vs ~19 times for NGVC with better margins structure and exciting growth prospects. All companies trade on much higher comps but Krogers (NGVC obviously has a liquidity premium with the family holding 59% of stock).

NGVC is currently a $590m biz on a TTM net income of $30.8m giving an earnings yield of 5.2% or 19.15 trailing P/e. If my projections (which I believe to be sufficiently conservative and aggressive) do convert to real numbers, the business could do around ~$50m net income 30 September, 2023 and free cash flow of ~$52m giving an earnings yield of ~8.5% or FCF yield of ~8.8% by 2026 at today’s price. I think this is a very attractive & reasonable valuation for the quality and growth the business displays and can achieve respectively.

I expect revenue to compound at around ~8% on 2023 to 2029 basis, and EBIT and EPS at around ~20 – 22% for the same period.

The following is my DCF summary: -

Given these numbers I expect an exit of 22 trailing multiple on 2026 EPS number of $2.14. I expect the company to raise the quarterly dividend to $0.16 a share from $0.10 a share. The current credit facility limits shareholder cash distribution to $15m (my dividend meets $14.6m shareholder distributional). However, when the company has sought for, it has been allowed special dividends, which was $2.00 in 2020 and $1.00 in 2023. The company this year has comparable results to declare one, but shall it declare is a question I’m not trying to answer. We can expect to receive ~$1.3 in dividends during the holding period which I will choose to reinvest.

Risks

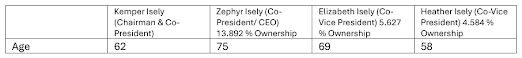

• Age of senior mgmt. and controlling family. (Isely Family Group 14.777% Kemper’s interest is possibly through this trust)

Kemper Isely (Chairman & Co-President) Zephyr Isely (Co-President/ CEO) 13.892 % Ownership Elizabeth Isely (Co-Vice President) 5.627 % Ownership Heather Isely (Co-Vice President) 4.584 % Ownership

This is a family run business and its future is ambiguous. I have seen some profiles on LinkedIn of possible children such as Raquel Isely, Lark Isely, Kara Isely but it’s unsure what the future holds.

• Store closures are a bigger risk than lack of store openings. NGVC has a strong business model with store openings likely to continue but theft, operational difficulties (both driven by inflationary environments) and a tough real estate market for lease renewal may hurt my projections

I calculate my downside as follows: 2 store closures per year and 5 openings (instead of 6 openings and no closures). My 2026 exit is instead at $2 EPS with a 19x trailing multiple giving an exit price of $38 over two years.

• We may see convergence to mature comparable sales (5 year+) to ~3% instead. In this scenario, we not only lose topline but also operational leverage

I calculate by downside by keeping operating margins at constant at comparable sales at 1.5% price/mix (avg ticket) & 1.5% organic volume (#transactions) coupled with store closure risk: -

2026 EPS: ~$1.6, Exit Multiple Kroger P/E: ~15x TTM EPS, ~24. With dividends we can still break even on the stock.

On the flipside same store sales have an arithmetic mean of ~7.2% excluding the oil crash and 21-22 inflation (I have taken 23 number). Even at a 6% same store sales growth, 100bps higher than industry compounding as per NBJ, we can look at a ~$55-60 target price before pricing in more operational leverage and a higher multiple.

There is strong risk asymmetry, and in my opinion, arguable market discount to where the stock trades right now.

Comments

Post a Comment